Using our heads to solve your Reward challenges.

We all know about the cost-of-living crisis and hear daily about costs increasing, and this is equally true for the costs of the benefits we are providing to our employees. We all recognise that it's a real challenge to balance the benefit costs, the benefit offering, and remain competitive in attracting and retaining talent.

Those of us in Reward are always looking to ensure our strategy is focused on providing the best propositions for attracting and retaining talent for our organisations. This has certainly been a key focus for our benefit strategies in recent years. However, in the past year we have had to add cost focus as another key influence on how we set our benefit strategy.

It comes as no surprise that we are seeing increasing costs in a wide range of benefit areas. Our clients are keen to review these and gain the best cost advantage possible. Some of the trends we are seeing in the market are as follows:

Increasingly we are working with clients who are keen to know how well their benefit propositions align to market to ensure competitiveness. And then in addition to this, there is often a key focus on how can we get the best from our benefits/maintain our benefits or enhance them on a “cost neutral” basis.

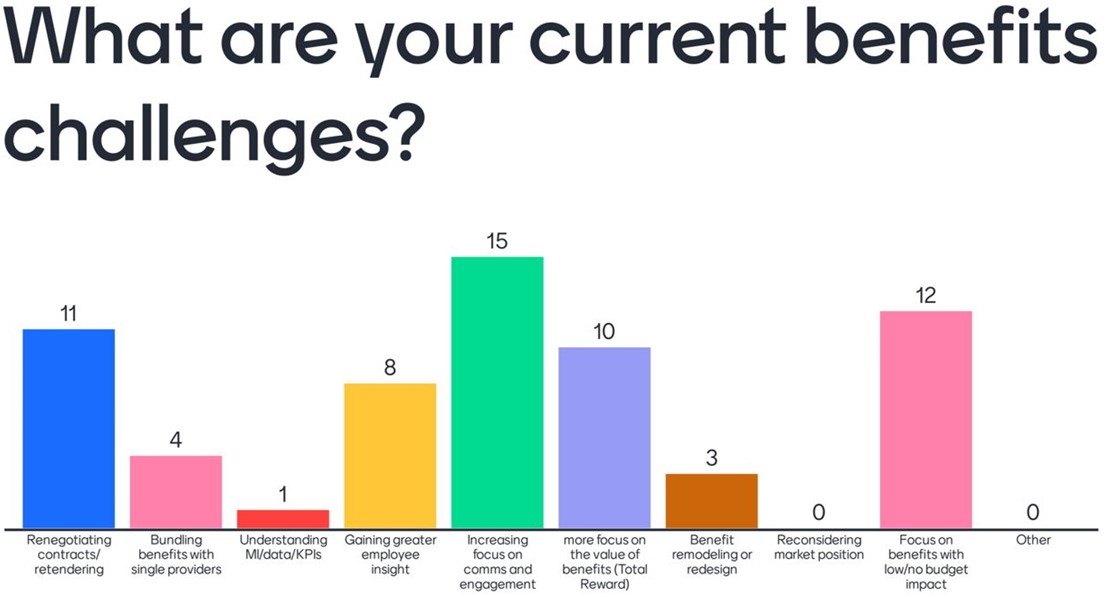

In a recent forum we ran, you can see the split of how the organisations are planning to manage benefit budget versus benefit provision.

"Which of the following matches your current position?"

Our survey results align very closely with a recent article published on benefit budget which identified that about one third of organisations are seeking to increase/improve their overall benefit budget to continue offering the same competitive benefit proposition or improve their current proposition.

Fewer than 10% of organisations are reducing their overall benefit offering but we are led to believe that the number of organisations considering this may increase to around 25-30%.

In our work with our clients, we have identified a number of opportunities to support them in successfully managing their benefit budget. These may be useful in setting your own agendas:

In addition, here are some of the other initiatives we are supporting our clients with to get the best out of their existing benefit budget:

Here at Reward Heads, we also look to try to identify creative solutions to the challenges of providing a great benefit offering.

Case Study

Here's a great example of work we did recently. Private Medical Insurance costs for our client had increased by over 15%. The PMI scheme was fully funded for around 600 employees at employee only cover. The policy had an employee excess of £100. In negotiating with their providers, we were able to identify that increasing the excess to £150 and introducing a Medical Cashplan with the ability to claim back the £50 increase in excess was a cost neutral solution. It worked really well from a negotiation and employee experience proposition as we bundled both benefits with the same provider.

The outcome for employees was great as with the introduction of a new cashplan they were then able to claim back some of their basic medical expenses which they had been unable to do previously.

In our benefit reviews we are conducting with our clients we are not yet seeing examples of organisations looking to realign to market but it's possible we may see this in organisations where they have previously enjoyed offering benefits above market median.

In our forum, we asked what they are currently doing to potentially overcome the challenge of benefit costs increasing:

You may have already seen our recent article on Communication. If so, here is just a brief recap.

With recent clients, focusing on communication has been probably the most enlightening and cost-effective solution to enhancing employee benefit experience without necessarily needing to increase costs.

Here are some of the areas we work through with our clients to understand how best we can enhance the current benefit communication and engagement:

We recently worked with a client to promote pension salary sacrifice with a focused communication plan. The engagement levels were truly impressive and not only did the employees benefit from participating in a salary sacrifice arrangement with NI sharing but the organisation also had the opportunity to make an NI saving to plough back into their benefit spend.

So in summary, yes we are all facing increasing costs to provide benefits to our employees but by thinking smarter and more creatively it is possible to provide the same or better benefits without seeing soaring benefit costs.

Reward Heads work with a large range of clients on benefit and we would love to support you. Please get in touch with Jannine, or our CEO Victoria Milford, at rewardsolutions@rewardheads.co.uk

This article uses aggregated data provided anonymously from our Reward Forums. We run several forums at Reward Heads for no cost and strictly on 'Chatham House' rules - for more information please email marcus@rewardheads.co.uk

Jannine Smith - Senior Consulting Manager